Updated Company Tax Page

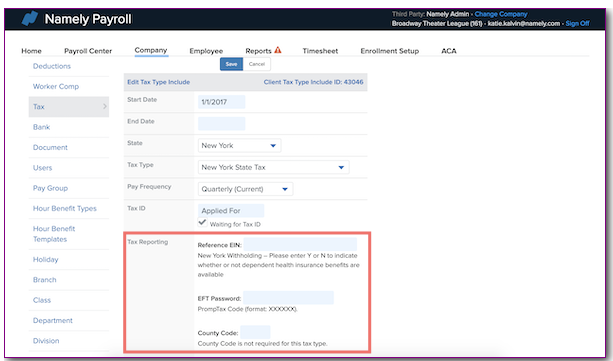

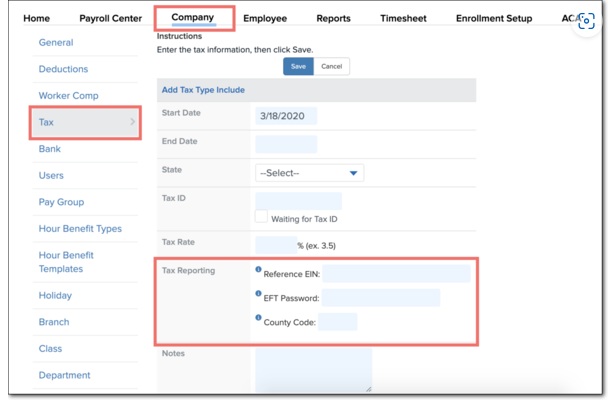

We are bringing the following additional ID number fields into each tax type in Namely Payroll: * Reference EIN * EFT Password * County Code

OVERVIEW

In order to remit certain federal, state, and local taxes on behalf of our clients, tax agencies require Namely to provide various ID numbers that identify us as the remitter. Some tax jurisdictions require more than one ID number, while others don't require any. Previously, these ID numbers were entered in Namely's backend and not accessible to client administrators.

To prevent penalties and interest that may result from delays in receiving these ID numbers from clients, we are exposing these ID fields on the Company > Tax page, so they can be entered by administrators or internal Namely users as soon as they become available.

If you currently have any tax ID numbers entered in Namely's backend, these will be automatically populated in the new fields when they are exposed on the Company > Tax page.

ACCESSING TAX REPORTING ID NUMBERS

To access the tax ID numbers, go to Company > Tax in Payroll.

There are three possible tax reporting IDs that may be required:

-

Reference EIN

-

EFT Password

-

County Code

Reference EINs

A reference EIN is a 25 character, alphanumeric company identifier. These numbers work like a personal SSN for companies to pay state and federal taxes. When an employee is hired in a new state where the company currently does not have taxes set up, it should register for a state tax ID number (if required in that state).

States That Require a Reference EIN

Please note: A reference EIN is not required for all states or tax types. Current states that require reference EINs include:

-

California

-

Colorado

-

Illinois

-

Iowa

-

Mississippi

-

New Jersey

-

New York

-

North Carolina

-

Pennsylvania

-

Washington

Specific Taxes That Require Reference EINs

-

Federal Employer Railroad Tier 1 Compensation (FE0000-412) – Railroad Retirement Board Number

-

Federal - Employer Railroad Unemployment Insurance Compensation (FE0000-425) – Railroad Retirement Board Number

-

California Withholding (CA0000-001) – H for a household employer; otherwise, blank

-

Denver OPT CO0080-051) – Z if employer is a true zero filer as defined by the agency, and does not need to make minimum payments; otherwise, blank

-

Illinois Withholding (IL0000-001) – Sequence number

-

Illinois Unemployment (IL0000-010) – L for an LIMRiCC Participating Library

-

Iowa Withholding (IA0000-001) – Business eFile Number

-

Mississippi Withholding (MS0000-001) – Account Type: WTH for Employees, WTHL for Employee Leasing, or WTHG for Gaming

-

New Jersey Unemployment (NJ0000-010) – If employer is a State college/university, the four-digit Syn code for amended wage reporting

-

New York Withholding (NY0000-001) – Y or N to indicate whether or not dependent health insurance benefits are available

-

North Carolina Unemployment (NC0000-010) – Seven-digit Branch ID for e-filing

-

Washington Unemployment (WA0000-010) – Unified Business Identifier Number

-

Washington Labor and Industries (WA0000-150) – Participation Activation Code

-

Washington Unemployment (WA0000-010) – Unified Business Identifier Number

-

Washington Labor and Industries (WA0000-150) – Participation Activation Code

-

Washington - Family and Medical Leave Insurance (WA0000-014) – Unified Business Identifier Number

-

Washington - Employee and Employer Family Leave Insurance (WA0000-025, WA0000-035) and Medical Leave Insurance (WA0000-026, WA0000-036) – V if employer provides a voluntary plan, or blank for a state plan

-

Wyoming Unemployment (WY0000-010) – WC Employer Number

-

PA Berks LST (PA9902-LST) – Six-digit EIT Account Number

EFT Passcode

An EFT password is a 20 character, alphanumeric pin, password, or verification code assigned by the taxing authority (also known as a pin).

State Taxes That Require an EFT Passcode

-

Colorado State Income Tax

-

Iowa SUI

-

New York State Income Tax (NY PrompTax)

County Code

-

Indiana Unemployment: County Code in which the company is located. If the company is not located in Indiana, use code 93.

-

Iowa Unemployment: County number identifying the single worksite. Leave blank for multiple worksites.

-

Texas Unemployment: County code in which the company has the greatest number of employees.

ENTERING ID NUMBERS

Depending on the tax you are adding, each field will display whether that specific ID number is required, and if so, provide instructions to assist you.